What is Bookkeeping?

Bookkeeping is a technique that assists you in understanding your business’s economic status. It’s a process that involves monitoring trace of the funds arriving in, that is your earnings. Expenses reflect the total spending outlay.

Why does Bookkeeping Matter?

Bookkeeping help for a small business is crucial because it helps the business owners understand what they’re owed, what they owe others, and how much money they currently have. All these factors are crucial to the company’s survival.

Read on to better understand bookkeeping, and learn several easy-to-follow bookkeeping tips that could very well save your business from financial penalties or worse.

What’s the Discrepancy Between Bookkeeping and Accounting?

Bookkeeping organizes a business’s monetary data, while accounting takes it a step further by analyzing and interpreting the data. Further, accounting supports a company to plan ahead, create financial documents and statements, prepare to handle taxes, and help with many financial responsibilities that keep a business stable.

Bookkeeper vs Accountant

A bookkeeper concentrates on a company’s daily financial tasks. They record information and preserve exact documents. An accountant’s scope of work goes beyond this, supplying crucial monetary understandings by assessing company data, e.g., deciding what equipment to buy, If or not to acquire other businesses, and also providing cost-benefit analyses and weighing in regarding additional significant decisions.

See below for other key differences between a bookkeeper and an accountant.

| Education | Licensing | Compensation | |

| Bookkeeper | In some cases, only an associate’s degree is needed | Not typically required. | The Bureau of Labor Statistics states that bookkeepers typically make anywhere from $32,000 to $69,000 (in America). |

| Accountant | Usually, a bachelor’s degree in accounting or finance is required. | In most states, to be a Certified Public Accountant (CPA), you will need to pass an examination. | An accountant (in America) usually makes between $50,000 to $137,000 a year according to the Bureau of Labor Statistics. |

Some Bookkeeping Principles

Bookkeeping might appear complicated, it’s actually simpler than many people think. Let’s go over a few of the fundamentals of bookkeeping to supply you a framework of comprehension before proceeding to the intricate specifics. This is not an exhaustive list of bookkeeping basics, it will give the necessary context to comprehend the procedure.

What’s Your Bookkeeping Strategy?

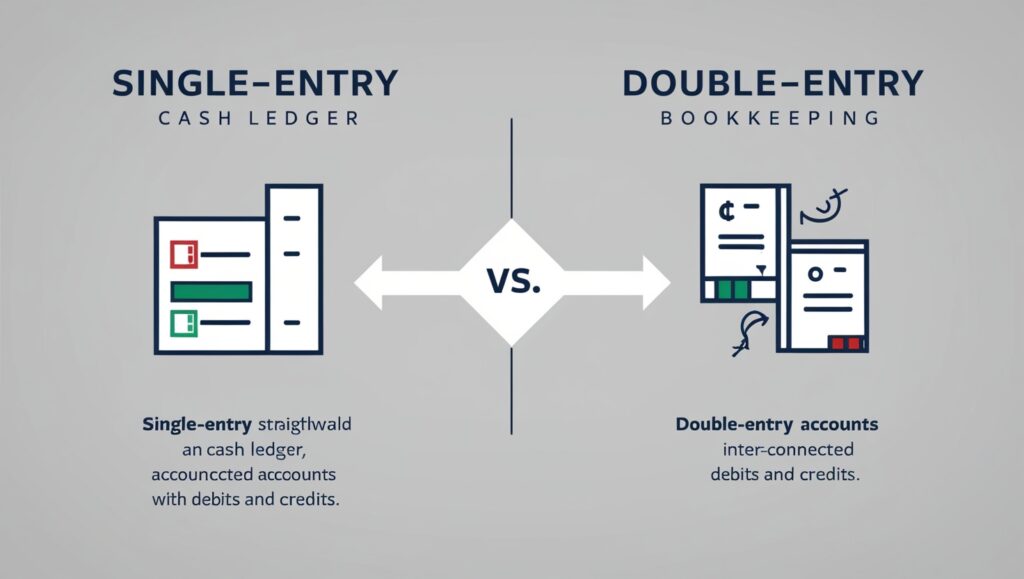

If you possess a modest business, a single-entry system could be your choice. For instance, using a ledger book to manage monetary records. It’s a fantastic option if financial expertise is not your strong suit.

If you’re a larger company, a dual-entry system may be a better choice. In this method, Each transaction is documented in at least two accounts, with one account showing a debit and another showing a credit.

Choose Your Accounting Method

Determine whether you wish to document on a cash basis or an accrual basis (whenever a transaction happens, i.e., without paying mind to the payment). The accrual strategy is a great choice if you want a more detailed look at your company’s results.

Classify Your Transactions

To guarantee the utmost degree of precision, label your exchanges into groups, e.g., income, wealth, costs, and also liabilities.

How to Divide Business And Personal Finances

To avoid confusion, keep your personal and business finances separate.

Don’t Go Old School

Although if you are technologically averse, utilize financial management tools that is out there, such as QuickBooks (more on that later). If you’re really hesitant to add more technology to your life, Think about delegating your bookkeeping requirements (more on that later as well).

In-house Bookkeeping

When we say in-house bookkeeping we are mentioning to the position conducted performed by individual within the company. Here’s a summary of the main advantages of having an in-house bookkeeper, in addition to an additional advantage.

Immediacy

If you require to modify your accounting documents ASAP, internal record-keeping is crucial. You can retrieve your documents instantly. You can adjust them just a few minutes after you’ve opened your laptop.

This sense of speed likewise applies to obtaining answers to any financial questions and instantaneous choice-making.

Personalized Financial Strategies

An in-house bookkeeper can tailor financial strategies to suit the company’s requirements, and an accountant’s in-depth understanding of the company’s management.

Flexibility

In a modest enterprise, employees can often wear multiple hats, performing various functions as needed. When you possess fewer accounting requirements, you may assign your internal accountant to other tasks.

Collaboration

Having someone internally fill the position of a bookkeeper might allow for enhanced conversation and result in improved collaboration.

Industry-Specific Customization

Organizing your bookkeeping framework for your industry’s niche may assist in maximizing the advantages you reap. To perform this correctly, you should pay proper attention to sector-particular software that can assist your bookkeeping requirements. As instance, a landscaper could use Yardbook, which offers customized landscaping bookkeeping, such as tools tracking, scheduling, plus job management, among other features.

QuickBooks, while not particular to landscaping, acts as excellent piece of financial oversight software that still provides bookkeeping help for numerous small enterprises. Some of its many services include managing payroll and pricing tasks and jobs.

QuickBooks also offers many tools for cash flow management. All of these offerings are essential for maintaining proper in-house bookkeeping, Ensuring proper financial management for small enterprises.

Due to these factors, and a host of others, QuickBooks Online is often regarded as among the finest online bookkeeping services accessible.

Outsourcing Bookkeeping

Should you lack the availability or interest to manage bookkeeping in-house, Certainly, there is another choice. Consider contracting out your bookkeeping requirements to a freelance bookkeeper or an accounting company. Each option has its advantages and disadvantages, and the choice is largely a personal one.

Read on to learn more about the differences between employing a independent bookkeeper and a bookkeeping firm.

| Cost | Security | Familiarity | |

| Bookkeeping Freelancer | Less expensive | You must implicitly trust the bookkeeper, as they will be handling your sensitive financial information. | You will get to know the freelancer better as you will work with them individually. |

| Bookkeeping Firm | More expensive | There is more accountability within a company, which means they tend to have better security. | A firm tends to be less personal. |

Why Should I Outsource My Bookkeeping?

Data Security

When dealing with financial documentation, data security is extremely important. Outsourcing your bookkeeping might assist in providing peace of mind as bookkeeping professionals usually follow stronger security protocols than ordinary people do.

Scalability

Let’s go back to our landscaper example. Their tasks tend to become seasonal, during the spring along with summer nearly overwhelming them with work. Thus, during their peak season, they require scaling up their bookkeeping services and could gain from delegating.

Better Cash Flow Management

In case your company has wide fluctuations in revenue and expenses, say a landscaper who makes greater during the summer, but additionally possesses expenses, e.g., in addition to protecting you from having to repair or replace equipment, contracting out your bookkeeping could likewise be a clever choice.

Relevant Expertise

Bookkeeping firms frequently possess a broad spectrum of expertise in various sectors. Their assistance can provide invaluable suggestions for your business’s industry that you may not be aware of.

Tax Preparation, Made Simple

When tax season arrives, having a expert handle your bookkeeping can free up a significant amount of time and frustration. So, confirm your small business is fully tax compliant, outsourcing could be a fit for you.

Improved Financial Statements

Speaking of frustration, contracting out your bookkeeping might likewise save you the stress of having to fix each the little (and big) mistakes that come with handling your personal accounting. Delegating may also assist prevent bigger stressors, like having to pay penalties, or worse, facing audited.

Conclusion

Bookkeeping help for a small enterprise is multi-faceted. First, It’s crucial to distinguish between the position of a bookkeeper plus that of an bookkeeper. A fundamental comprehension of bookkeeping is also crucial for contextualizing, plus perhaps demystifying the intricacies of bookkeeping. You’ll also need to decide whether to do the work in-house or hire a freelancer or bookkeeping firm.

Ultimately, the decision is a matter of personal preferences. Would you like to spend a bit more cash out and partner with a firm? Would you collaborate one-on-one with someone? Would you rather have someone in your business complete the position?

If you run a small company, we would love to hear your thoughts. What stood out to you about bookkeeping’s impact? Has good or poor bookkeeping affected your company’s progress? What challenges have you faced with your bookkeeping?

1 Comment

Pingback: Comprehensive Guide to Picas Greenhouse Productions System with Business Central